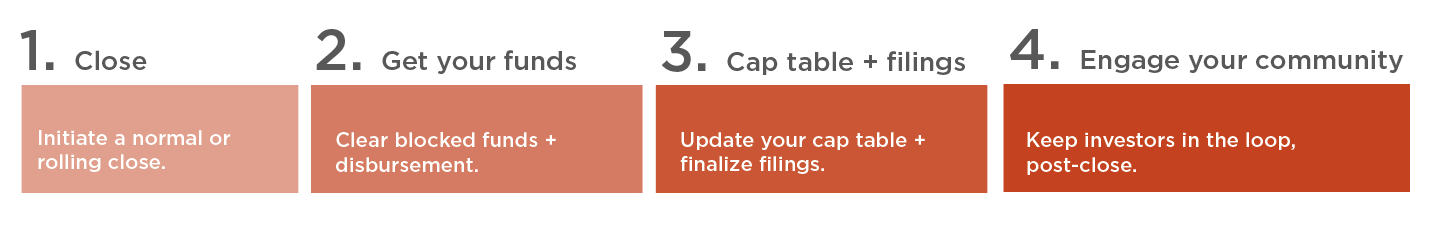

This guide covers everything you need to know about accessing your funds and finalizing your Wefunder round — from wrapping up administrative details and finalizing investment commitments, to completing investor documents and receiving your funds.

I. So what does ‘Closing’ Mean?

Your round officially closes on the date set in the Form C, meaning, this is the deadline to reach the minimum target offering. If you don’t reach your minimum by this date, you’ll have to either extend your round or cancel and refund investors.

If you do reach your minimum, congrats! We’ll start the process of disbursing funds to you.

Where do I find my round close date? Can I change my close date?

You can see when your campaign is ending on your /overview and /manage page.

Prior to filing a Form C, there is no close date, and you do not need to extend to continue raising.

If you have filed your Form C, you are able to extend your campaign as far out as your financials allow, typically April the following year. You can find your legal round close date in your Form C in the first section, under “Deadline to reach the target offering amount.”

That said, if a fundraise is extended within 2 weeks of your listed close date, emails about your close will begin to be sent to followers & investors, so if you would like to extend please let us know as soon as you are able.

You can read more on financial requirements here.

If you are up against your financials expiring, you would be able to extend your raise by materially amending your Form C with the next year’s financials. Reach out to your Wefunder contact or launch@wefunder.com for help with this. Please note that you must reach out 10 days prior to your current round close date if you’d like to extend (or by April 1st if you are closing when financials roll over in April).

You can choose to close your round early (provided it's been open for at least 21 days since filing), though you must provide investors with a 5 business day closing notice. To make adjustments to your close date, reach out to us at closing@wefunder.com.

How does closing work?

Three weeks before your round closes, we’ll reach out to confirm the date your round is closing and initiate next steps. If you would like to extend, you can do so at this time. At this time, we’ll provide an update on:

- Funds committed: This refers to all investments committed to a round — whether funded or unfunded. It’s every dollar someone said “I’m going to give to [company],” whether or not we have the money in escrow yet.

- Funds available: This includes all investments with funds in escrow and ready to be disbursed.

- Unavailable or "blocked" investments: This includes all investments which are either unfunded or have funds in escrow but are not ready for disbursement due to another issue (learn more about issues that can block an investment in Section II).

In order for your round to be successful, you must clear your minimum target offering with available funds. It is okay if unavailable investments become available after the campaign closes, but all commitments must be made before you close.

If you are unable to reach your minimum target offering in available funds, your round will be canceled and all investors will be notified and refunded.

II. Getting your funds

Congrats on your successful round! So what’s next?

If you have more than $10,000 in escrow as “is read” and substantial funds still pending, we’ll automatically begin your first disbursement the Friday following your campaign’s close.

You’ll then have four weeks to help investors complete any pending or blocked investments. During this time, our team will reach out to those investors directly — and we may ask you to send a reminder or two as well.

Here’s what that looks like:

Week -1: “5-day closing” email

Week 0: “Closing today” email + partial disbursement

Week 1: Investor notification

Week 2: Investor notification

Week 3: Investor notification

Week 4: Final investor notification + final disbursement

Once the deadline has passed, we’ll cancel all remaining blocked investments and send your final disbursement.

To resolve an issue with an investment, investors can visit their "My Investments" page at wefunder.com/portfolio. Here they will be able to see and resolve any issues with their investments.

- Needs transition: The investor made a reservation before the campaign was officially live and now needs to move their funds over to the live campaign. NOTE: an investor cannot do so once the campaign has closed to new investments.

- Payment failed or missing payment: The investor has committed to investing but we have not yet received their payment.

- Reconfirm investment: If an investor needs to reconfirm their investment due to a material change, their funds (even if in escrow) will be blocked until this is resolved. If the investor doesn’t reconfirm the investment within 5 business days of viewing the material changes, the investment must be canceled per SEC regulations.

- Re-sign contract: If an investor needs to re-sign their contract to agree to some change of terms during the raise (i.e. if they’ve been downgraded from Early Bird to Regular terms), their funds (even if in escrow) will be blocked until this is resolved.

- KYC/identity verification: We're unable to verify the investor's identity with the documents provided; they'll need to provide a photo ID or their SSN.

- Accreditation verification: We're unable to verify accredited status with the documents provided; they'll need to upload a document to verify their status as an accredited investor.

- Tax ID: investors must provide a tax ID number in order to invest so that the appropriate tax documents can be distributed when there is a taxable event.

- Reconciliation and refunds: These and a handful of other blockers are mostly housekeeping on Wefunder’s side, and we usually don’t handle them until it’s time for a final tranche. However, if all other blockers have been cleared and our housekeeping items are keeping available funds from climbing over your minimum, we’ll make an exception and clear them early.

Closing capital while the round is open:

Some founders choose to take advantage of rolling closes, which allows you to withdraw available funds from your round while it remains open to new investments.

To qualify, you must have:

- At least your minimum offering amount in available funds.

- Available funds must include the Wefunder lead investor (unless they already invested outside of Wefunder).

- A significant portion of the investment cannot come from key members of your company.

- More than 21 days has elapsed since you have filed your Form C.

- Valid wire information has been uploaded.

- You become eligible for subsequent rolling closes each time you have another $50k in your available funds, and it’s been more than 1 month since your previous rolling close.

Please note — legally, any investor has the right to opt out of investing during these 5 business days. So it is technically possible for your (rolling) disbursement to fall through at this stage. For example, let's say you have a $50K campaign minimum, and $55K in available funds on October 1st, when the 5 day opt out emails are sent to investors. If an investor cancels their $10K investment on October 3rd, you would now have only $45K in available funds, and the disbursement would have to be cancelled, because $45K is less than your campaign minimum of $50K. Situations like this are highly unlikely, but technically possible.

Investors with investments eligible for disbursement must first be notified that you're initiating a rolling close and will have 5 business days to opt out of the tranche. For your first rolling disbursement, once the 5 business day period is over, and provided you are still over your minimum in available funds, you can receive a disbursement. For subsequent rolling closes, we require you to have at least $25,000 in (additional) available funds. For example, if we have already disbursed $100K to you, when you pass $25K in additional available funds, you can schedule your next disbursement. We also require at least one month between rolling closes. Disbursements occur weekly on Fridays. If there is an issue, we will notify you. Depending on your financial institution, the disbursement will hit your account within a few business days.

When you withdraw funds during a rolling close, you will need to countersign contracts for all investments included in the rolling close. This means that you’ve executed contracts and your round is officially successful. It also means that you can no longer cancel your round and refund investors whose funds you have withdrawn. Note: Once you get the email with contracts to countersign, we will have to disburse those funds before we can send any more, or schedule you for any other disbursements.

If you’d like to initiate a rolling close, reach out to us at closing@wefunder.com to confirm the status of your available funds. Note: it usually takes a few weeks to receive your funds.

Final Closing, after the round ends:

Our goal is to get you your final tranche of available funds within one month of your close date. A member of our Closing Team will check to make sure your available funds are over the minimum threshold, if you haven’t yet received a disbursement, and work with you to schedule a tranche date.

Once the deadline has passed, we’ll cancel all remaining blocked investments and send your final disbursement.

Finalize Filings

Once all investments are disbursed, we’ll follow up with a zip drive of your executed contracts and a final investor list. These documents can also be downloaded from wefunder.com/[companyname]/contracts. Remember, once contracts are executed, you have a legal relationship with your investors. Be mindful to adhere to the terms of the contract, and to keep their personal information secure (i.e. do not share investor lists with third parties).

Form C-U

Once your fundraise is complete, we can help you file a "Form C - Progress Update" (Form C-U) with the SEC, which states the final amount you’ve raised in the round.

Form D

If your raise had a Reg D component, you’ll need to file a Form D with the SEC. This is a simple filing that you’ll need to have your own lawyers take care of.

III. Updating your Cap Table

SPV Structure

If your fundraise used our SPV structure, all of your Wefunder investors will be grouped into one to three lines on your cap table, depending on how many SPVs you have.

- Fundraises without early bird/VIP Member terms will have just one SPV named [Company Name] [#], a series of Wefunder SPV, LLC.

- If you used Early Bird/VIP Member terms, there will also be a second SPV holding your early bird investors, called [Company Name] [#] EB, a series of Wefunder SPV, LLC.

- If some investors invested using Reg D there will be another SPV holding your Reg D investors, called [Company Name] [#] D, a series of Wefunds, LLC.

Stock or convertible certificates should be issued to the SPV(s) based on the date of disbursements you received. So if you had more than one closing, your SPV(s) will be issued more than one certificate. This just means they’ll be listed more than once in your stock ledgers, even though they take up only one line on the cap table. If you offer Early Bird/VIP Member terms, you may need to divide up a disbursement into two stock certificates (one for the Early Bird/VIP Member SPV, and one for the regular SPV). Certificates for the SPVs can be issued (i.e. sent) to updates@wefunder.com. If you use a digital cap table management system (like Carta, Pulley, etc.), please add the following information:

- A Quick Example: Jake’s Rakes raised $5.5M in SAFEs, of which the first $1M was on Early Bird terms.

- The last $500K was raised via Reg D. The company did a rolling close of $500K on March 1, and a final close of $5M on July 1.

Here are the stock certificates Jake would issue:

Direct Structure

If you didn’t raise using our SPV structure, then each investor should be listed individually on your cap table based on the date their funds were disbursed to you.

If you have any questions about how to list your Wefunder investors on your cap table, email our closing team at closing@wefunder.com!

IV. Engaging your Army of Supporters

Woohoo! You’ve completed your raise and now have hundreds (or thousands) of investors. Your investors backed your vision because they believe in you - keeping them updated shows that you value their support and trust.

Make Good to Your Investors

Revisit your pitch page, investor contracts and Form C to see what is owed to investors. This includes sending out any promised perks and repayments where applicable.

For Revenue Share or Loans: Ping closing@wefunder.com to make sure your repayment schedule is set. You can find the terms in the template contracts your team reviewed (also linked at the bottom of the Form C page). Keep in mind that Early Bird contracts will have different terms.

For Equity, SAFEs and Convertible Notes: Work with your attorney or reach out to updates@wefunder.com to learn about our partners who can work with you to issue stock certificates, provide cap table management, etc. We recommend keeping your Wefunder investors informed about this.

Send Investor Updates

We recommend posting quarterly investor updates on Wefunder, but we require that you update your investors at least twice a year.

Updates don’t need to be novels! A few bullet points about recent wins, photos of a recent event, or some high-level financial updates can all provide a snapshot of your progress. Remember, your investors aren’t just money in the bank – they’re potential mentors, networkers, and even future customers.

And when things get tough (as they often do in startups), be upfront with your investors. In our experience, investors who feel in the loop on the challenges you’re facing are much more understanding than those who feel blindsided by bad news.

Looking for an example? Check out our quarterly investor updates here.

Submitting an Annual Report

Under Reg CF, you’re required to file at least one annual report – due no later than 120 days after the end of your fiscal year. You can see the exact requirements in our FAQs here. Most companies only need to file one annual report and you aren’t required to get an audit or review of your financials done for the annual report.

Update Us on Value-Changing Events

When you raise with Wefunder, you agree to notify us of any future events that affect your investors. This could include subsequent financing rounds, conversions, mergers, acquisitions, IPOs, or dissolution. If you are nearing an event, please loop in updates@wefunder.com as early as possible! This will allow us to help with logistics like signatures or payouts, as well as to update your investors’ portfolio views so that they know the current value of their investments.

Send Out Tax Documents

If your company is an LLC that’s taxed as a partnership or you’ll be making regular payments to investors, you’re required to send out yearly tax documents to your investors on Schedule K-1. They’ll then file this with their personal income taxes. If you’re using an SPV, you’ll also need to distribute K-1s when your company is acquired or liquidates. We can help provide you with the info needed to generate and distribute K-1s – email us at updates@wefunder.com.

Refer a Company, Get up to $10,000

Know any founders that Wefunder would be a good fit for? Refer a company to us and get up to $10,000 when they file their Form C. More details here.

Repeat Raises

If you would like to raise capital on Wefunder again in the future, we would love to work with you again! Feel free to reach out to your Wefunder contact or launch@wefunder.com at any point in the future. Repeat raises tend to be more successful, and easier — because you've learned the Wefunder system, and discovered what fundraising tactics are most effective for community rounds. Plus, you now have an army of investors, who can be your marketing team as you kick off your next raise.