Even for repeat founders, fully understanding the nuances of securities regulations can be overwhelming. While we can’t replace your lawyer's expertise, we can give a good layperson's overview.

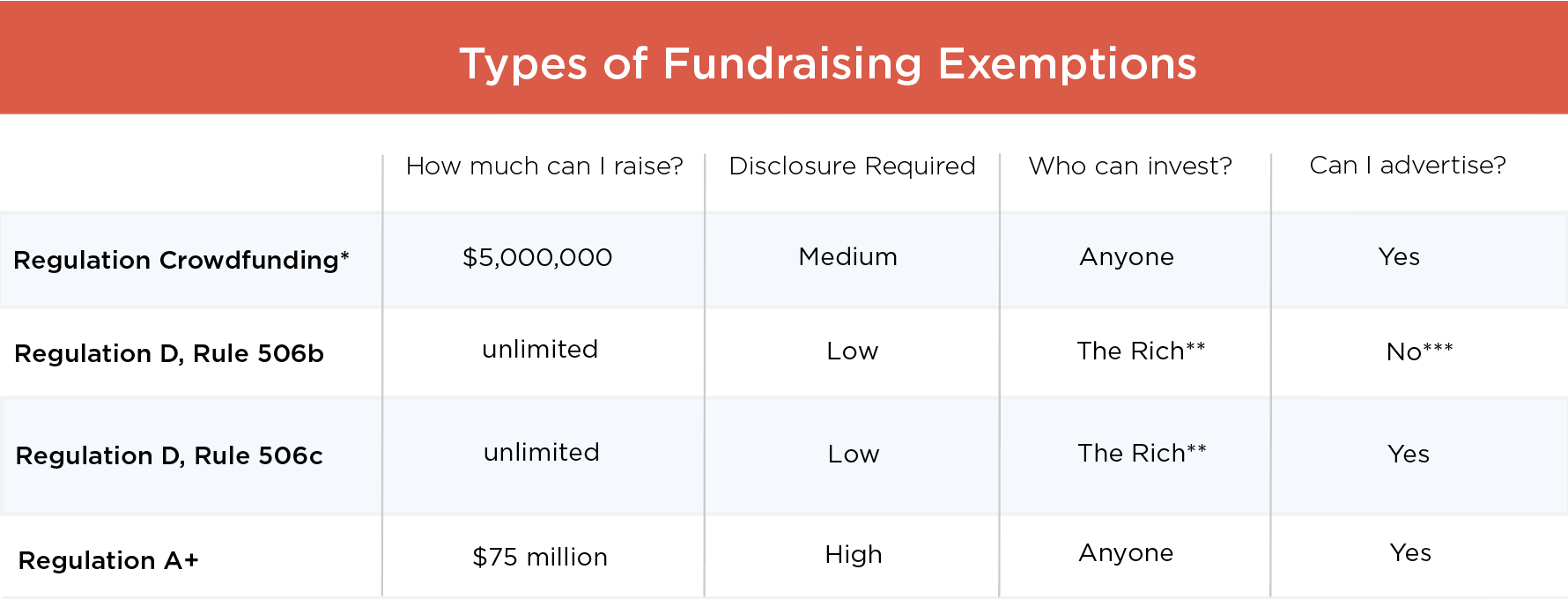

Wefunder supports 3 different ways to legally raise funding from investors in all 50 states under federal law: Regulation Crowdfunding, Regulation D Rule 506, and Regulation A+. Each has their own strengths.

**Rich means accredited investors with $1M+ in net worth (minus their home) or who've earned more than $200K per year ($300k with spouse) in each of the past 2 years. It also means institutions like banks and VCs.

Which should I use?

Regulation Crowdfunding (Reg CF) is our bread & butter – it's used by over 90% of the companies on Wefunder. It turns your most passionate fans into investors that are a marketing force, and puts you in front of 1.5M+ investors on Wefunder.

Regulation D, Rule 506b is what is traditionally used by big-check angel investors and venture capitalists. It doesn't allow for 'general solicitation' – ie. you can't advertise your offering – so it's not a great fit for a raising a large crowdfunding round.

Regulation D, Rule 506c allows you to raise an unlimited amount from accredited investors and permits 'general solicitation' (advertising).

Regulation A+ (Reg A) is best for late-stage companies with serious traction, seeking to raise up to $75M publicly. It’s like a "mini-IPO." Since there's a hefty up-front cost & considerable legal work for Reg A+, we usually recommend founders first launch a Reg CF and then get started on the Reg A+ legal work.

Reg CF is a law that rolled out in 2016 and just got a huge boost in 2021! It legalized the ability for anyone - not just the rich - to invest in startups. Businesses can raise capital from their friends and local communities instead of just banks or venture capitalists.

What we'll do for you:

We handle the grunt work of fundraising... so you can focus on what’s important: growing your business.

Who can invest?

Anyone can invest as little as $100 in your company! You can also advertise your fundraise to your customer list, in the press, or on social media (abiding by these rules). For most companies, Reg CF is the best way to maximize the amount invested, while allowing customers and friends the opportunity to support you.

How are investors organized?

Your entire raise will be consolidated into Special Purpose Vehicles (SPVs) – one if you don't use Early Bird/VIP Member terms, 2 if you do. Each SPV will take up only one line on your cap table! You'll pick one investor to be your Lead Investor and they'll act on behalf of all Wefunder investors. This will make later rounds of fundraising a breeze, while giving investors the same economic exposure and info as if they had invested directly in the company. A win-win.

Can I advertise my raise?

Absolutely! Reg CF rules allow you to advertise your raise in order to turn your friends, customers, and supporters into investors. In all communications, messaging must be factual and "non-term." The first bit is obvious – don't mislead investors. Avoid hyperbole, misleading info, or omission of important info. For instance, if someone is suing you for patent infringement, you should mention it. (Your communications must be filed with the SEC alongside your Form C, so no funny business). You also cannot include any terms of your raise.1

So, stick to factual statements or historical data and then direct people to your Wefunder pitch page to learn more. Also, prominently label any "forward looking information" or projections.

Get the full scoop on legally advertising your Reg CF raise here.

Can I fundraise off the Wefunder platform?

By law, all Reg CF investments must be made through a funding portal like Wefunder or via a broker/dealer. So you aren't able to collect checks in person – you must direct potential investors to your Wefunder pitch page.

How quickly can I start raising?

You’ll be able to launch a pitch & start spreading the word in minutes!2 This will launch your raise in its "testing the waters" phase – where you can gauge investor interest by collecting investment "reservations" prior to completing your legal work. These reservations are non-binding – investors can fund their Wefunder Cash accounts but no money is sent to you until after your legal disclosures are complete. More details on reservations and Wefunder cash here.

You're able to ping prospective investors during TTW, but note that any public statements (emails, Facebook posts, Tweets, etc.) that you make prior to filing your legal disclosures must include these disclosures. You must also take a screenshot of each statement to file alongside your Form C.

Once we help you finish your legal work, investors will be prompted to confirm their investments and then BOOM!3 Funding and an army of supporters ❤️

How much can I raise?

You can raise up to $5M per year under Reg CF, or an unlimited amount with Reg D.

Which types of securities can I offer?

We've got a library standard industry contracts for you to pick from – from the Y Combinator SAFE, a convertible note based on Cooley Go, & a standard revenue share template. We can also accommodate any custom contract drafted by your lawyer (for a priced round or another type of offering).

What legal work is required?

Our team will guide you through the legal requirements of your raise. Most importantly, they'll help you file a Form C with the SEC (required to collect your $$). To do so, you'll need to disclose up to 2 years of GAAP financials, along with other stats, like number of employees, officers & directors, stakeholders with more than 20% voting power, past fundraising rounds, user of funds, and any material risks.

The type of financial statements we'll need from you depends on the max amount you plan to raise. For raises up to $124K, you'll need a company officer to certify your statements. For raises up to $1.235M, you'll need them reviewed by an independent CPA. Above $1.235M, you'll need an independent audit of your statements. More details on financial statements here.

Don't get spooked! We're primed and ready to help you every step of the way.

Am I required to file ongoing filings post-close?

1 year after your Reg CF round closes, you'll need to file an annual report which covers much of the same info as your Form C (reviewed/audited financials are not required, though).4 Most companies only need to file one annual report. Legalese here.

Footnotes for your lawyer:

1. Advertisements cannot include the terms of the offering.“Terms of the offering" include: (1) the amount of securities offered; (2) the nature/type of the securities; (3) the price of the securities; (4) the closing date of the round, (5) the progress made towards fundraising goal, and (6) the intended use of funds. Full advertising guide here.

4. Annual reports terminate after 1 year if there are fewer than 300 shareholders. All investments on Wefunder, made under a single set of terms, will be aggregated into 1 SPV & count as one shareholder. Filing the annual report is not a condition of the exemption. The report includes financial statements self-certified by the CEO as well as a business discussion. No review or audit is required.

506(b) vs. 506(c)

Rule 506(b)

Who can invest?

Only accredited investors. Technically up to 35 “sophisticated” non-accredited investors can invest, but there is a heavy legal burden associated, making it rarely worthwhile.

How are investors verified as accredited?

Accreditation can be verified through self certification by investors (i.e., checking a box). This serves as a statement from investors that can be used by the issuer to reach a reasonable belief that the investor is accredited.

What are the limitations on the total number of investors & investments?

There is no limit on the number of investors or the amount that can be raised. If you wish to consolidate all the investors into a single SPV or fund, the law places a limit of 249 investors if the offering is under $10M in investments. If offering has more than $10M in investments, there is a 99 investor limit. Please see below for more information.

Is information about the offering required?

The law requires investors to be provided with the necessary information required to make an informed investment decision, but there’s no specific requirement on what information must be disclosed as long as all of the investors are accredited. If the offering includes any non-accredited investors, the issuer must disclose a large of amount of additional information, increasing costs and time spent preparing the offering.

Can the offering be advertised?

No, advertising is not permitted. However, it can be sent to investors who have a pre-existing relationship with the issuer. Because of this, 506(b) is not well-suited for a large crowdfunding round

Rule 506(c)

Who can invest?

Only accredited investors can invest.

How are investors verified as accredited?

Accreditation must be verified through “reasonable steps”, which can include a W-2, brokerage or bank statement, or a letter from a lawyer or CPA. At Wefunder, we help verify the accreditation of any potential investors wishing to invest in a 506(c) offering.

What are the limitations on the total number of investors & investments?

There is no limit on the number of investors or the amount that can be raised. If you wish to consolidate all the investors into a single SPV or fund, the law places a limit of 249 investors if the offering is under $10M in investments. If offering has more than $10M in investments, there is a 99 investor limit. Please see below for more information.

Is information about the offering required?

The law requires investors to be provided with the necessary information required to make an informed investment decision, but there’s no specific requirement on what information must be disclosed as long as all of the investors are accredited.

Can the offering be advertised?

Yes, advertising or “general solicitation” is permitted. Because of this, 506(c) is better suited for a large crowdfunding round

Reg D SPVs

Wefunder's Reg D Special Purpose Vehicles (SPVs) are designed to invest in early-stage companies with high growth potential and high risk. There are some rules that govern how these SPVs can operate:

They can't borrow more than 15% of the money they have to invest, and any borrowed money must be paid back within 120 days.

The securities that the SPV issues to investors can't give investors certain rights, like the ability to withdraw their investment or force the company to buy back their shares.

At least 80% of the SPV's money must be invested in "qualifying investments," which are generally equity securities (like stock) issued by private operating companies. Non-qualifying investments include things like debt securities, crypto assets, and investments in other funds or SPVs.

Regulation A+ is a new fundraising exemption that became active in late 2015, designed for later-stage companies who want to raise more funds publicly, but don’t want to do a full-blown IPO yet. It’s like a mini-IPO.

Pro:

You can raise up to $75M per year from anyone.

Con:

It's expensive & time-consuming.

Before you can start fundraising and collect funds, you need to pre-file an offering placement memorandum (OPM) with the SEC. An OPM is like a business plan wrapped with a whole bunch of legal disclaimers, and can cost up to $50,000 in legal fees. For this reason, early stage or unproven companies should not use Reg A+.

Even if you think you could raise over $5M, it's often best to start off with Regulation CF. We can get you started raising money months before your Reg A+ campaign will be ready.

How we help:

While drafting an OPM is a lot of work for your lawyer, once that’s done, we’ll handle everything else. We can work with nearly any type of security, and group all shareholders in one entity on the cap table.