Note: this article is only for companies raising equity (i.e. SAFE, convertible note, priced round).

The goal of this document is to answer three important questions for companies raising equity:

- What tax documents do I need to file for investors?

-

If I use an SPV, how will my tax obligations change?

- How much will filing those tax documents cost?

::

C-Corporations

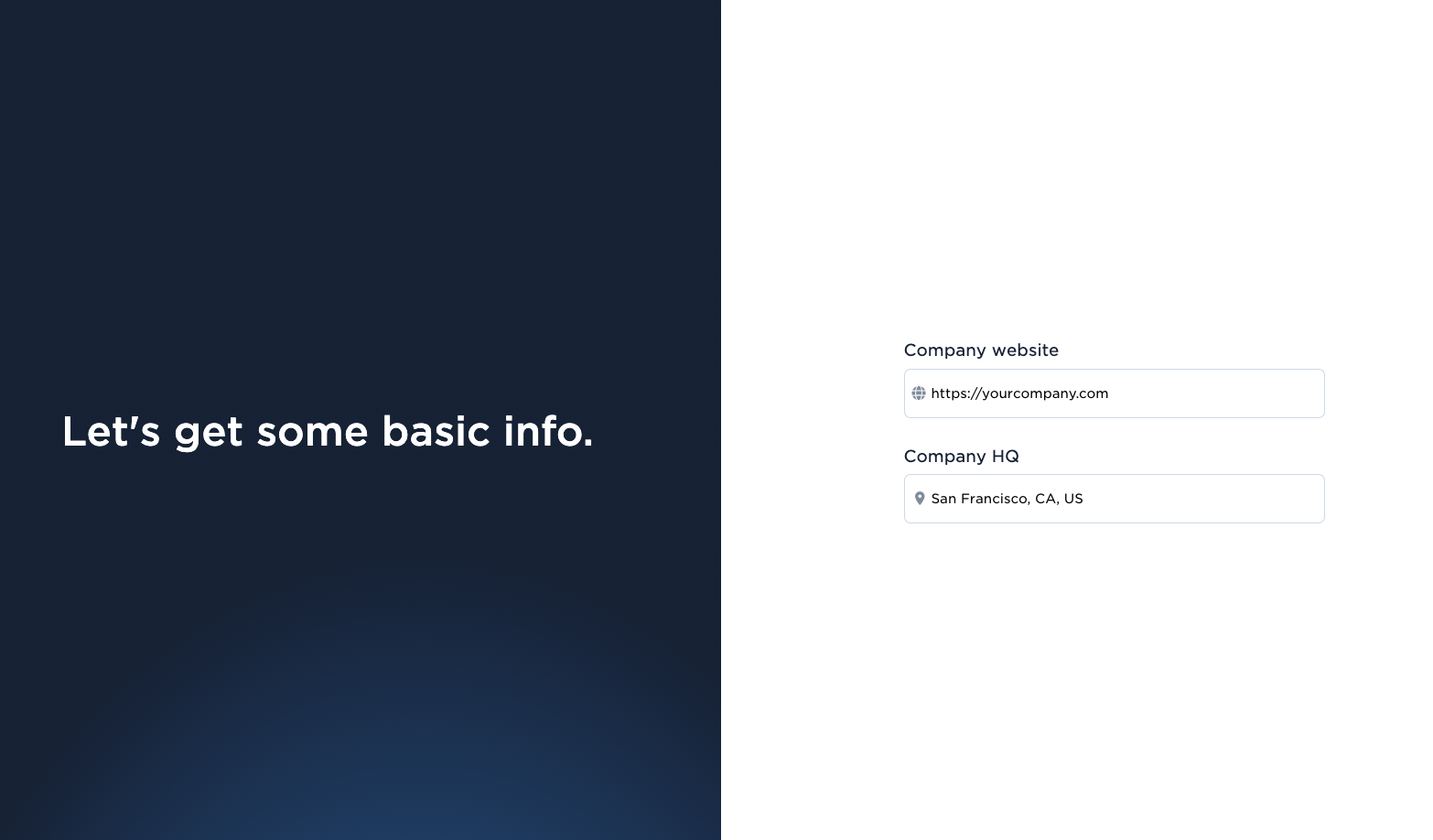

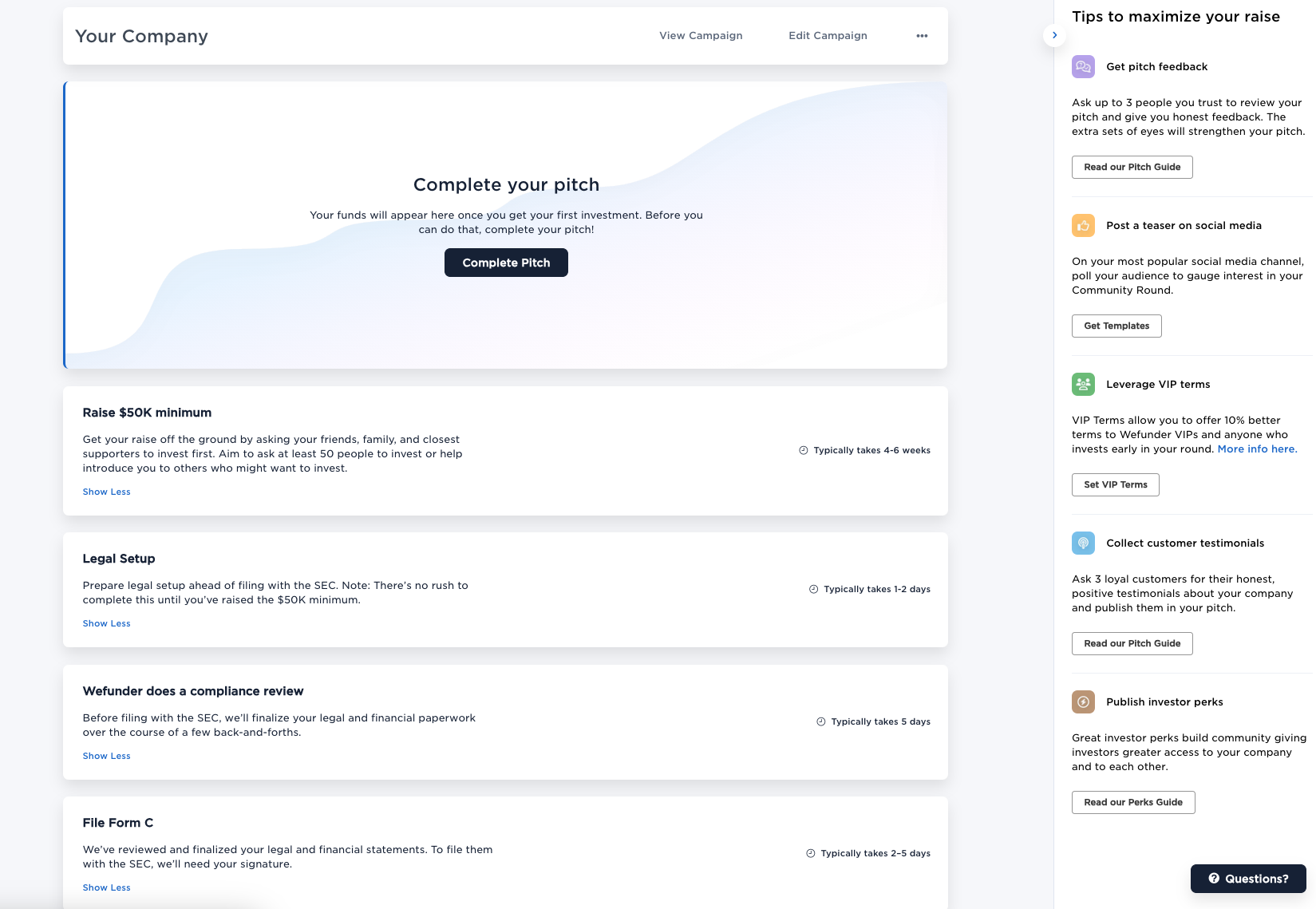

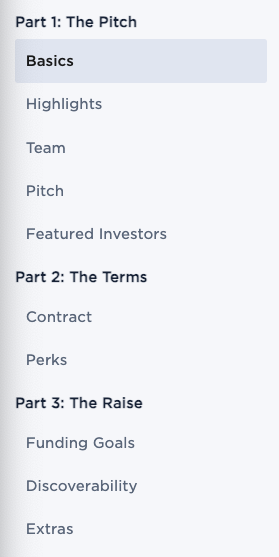

For C-Corporations raising equity, the Wefunder legal & tax process is relatively simple. There is only one decision you need to make: aggregate investors using the Wefunder SPV or take all investors directly on your cap table.

If you decide to take all investors directly, you will be responsible for all tax filings.

If you use the Wefunder SPV, we’ll aggregate investors into an SPV1 for you and file taxes for the investors when there are taxable events! Specifically…

- You’ll file your usual Form 1120 (U.S. Corporation Income Tax Return)

- We’ll file a Form 1065 for the SPV

- We’ll issue K-1s2 to all members of the SPV (i.e. your investors)

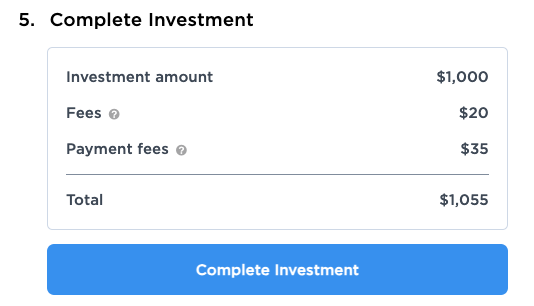

All of the above is included in the standard annual admin fee that companies pay Wefunder for all post-funding services. This annual fee is the lesser of $1K, or 0.5% of the amount raised.

::

LLCs

If you’re an LLC raising equity, it can get more complicated, depending on how your company is taxed. If you choose, we’ll still aggregate investors into an SPV1 for you and file taxes every year. However, the fee and legal requirements for that SPV may change, depending on how you’re taxed.

If you decide to not use an SPV, skip to the Taking Investments “Direct” section at the bottom!

There are three main ways an LLC can be taxed:

- Partnership

- C Corporation

- S Corp

Here’s what those options mean:

Partnership Taxation

This is the default tax option for LLCs. In a partnership, members of the LLC split everything and file taxes for their share, like roommates splitting rent and utilities.

Say your LLC has 2 partners (i.e. members) who split ownership 50/503. If your company made $100,000 last year, each partner reports $50,000 in profits on their taxes. The partners (i.e. you) file a Form 1065 for the LLC and a K-1 for each partner.

Being taxed as a partnership is often called “single taxation” or “pass-through taxation,” since there are no corporate level taxes. The only taxes on that $100,000 are paid by the partners themselves.

C-Corp Taxation

LLCs can choose to be taxed as a C-Corp, instead of as a partnership. If so, you’ll file a Form 8832 with the IRS to let them know.

In C-Corp taxation, the company pays income taxes at the company level, instead of passing through the profits to owners. Every year, you’ll file a Form 1120 (Corporate Tax Return), report all company income & expenses, and pay the corporate tax rate.

Say your LLC made $100,000. First, the company pays corporate tax on the $100,000. Then, if the company pays investors a $50,000 dividend, the investors will pay personal tax on that dividend.

That’s why C-Corp taxation is often called “double taxation”, since profits are taxed at the corporate and individual level.

S-Corp Taxation

Being taxed as an S-Corp is like being self-employed at your own business. Unfortunately, S-Corps can’t raise on Wefunder. If you want to raise with us, you’ll need to convert to C-Corp or Partnership taxation.

::

The taxation structure you choose might change your tax and fee obligations for the SPV. Here’s how that breaks down:

C-Corp Taxation

No changes! Since your LLC is taxed as a C-Corp, the process will be the exact same as described at the top of this document. You’ll file your Corporate Income Tax Return, then we’ll file taxes for the SPV and the Wefunder investors. And everything will be covered under the standard annual fee!

Partnership Taxation

Partnership taxation means profits/losses are passed through to partners every year. That means that every Wefunder investor in the SPV (which owns4 equity in the LLC) also needs to pay taxes on profits/losses every year.

Put simply, that makes it much more complicated for Wefunder to file taxes for your SPV and all Wefunder investors every year. In fact, it quickly becomes prohibitively expensive for us to do so.

That said, we are committed to making SPVs possible for every company that wants one! To cover our costs (i.e. time, CPA expenses) of preparing annual taxes for your SPV, we will charge a larger annual fee, in place of the standard annual admin fee.

Two important notes about the fee:

- The fee might not apply every year. If you are raising future equity (e.g. SAFE, convertible note), the fee will apply starting the first year after the investment converts into equity.

- The fee starts at $5,000 and may be more, if you have a large number of investors in the SPV.

Taking Investments “Direct”

Say you’re taxed as a partnership, but you don’t want to use our SPV and pay Wefunder the annual tax fee described above. The alternative is to take investments “direct” to your cap table. Every Wefunder investor will become an owner/partner in your LLC.

Since the investors are direct owners, Wefunder can’t assist you with taxes. You’ll be responsible for creating & distributing their K-1s, just as you do for every other partner.

You can absolutely do that, but be aware that it is more challenging – and potentially more expensive – than having Wefunder handle the taxes for you through an SPV. Wefunder gets discounts from our CPA partners, due to the volume of taxes we send them. We will happily refer you to CPAs in our network – their quote could be lower or higher than the annual tax fee Wefunder will charge.

We highly encourage you to check with your legal & tax advisor(s) before committing to taking investors directly.

This is for educational purposes only, and should not be construed as tax or legal advice.

Questions? Reach out to updates@wefunder.com

Footnotes

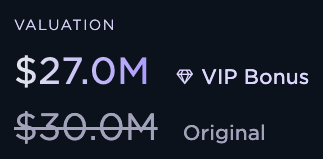

1 For companies with Early Bird and/or VIP terms, there will be two SPVs, one for each set of terms.

2 K-1 filings are only required in years where there’s been a liquidation event, dividend payment, or some other taxable event during the year.

3 If you don’t know your ownership split, it’s probably in your LLC’s operating agreement. Look for a statement like “Partner A gets 60%, Partner B gets 40%”

4 If the company raises future equity (e.g. SAFE, convertible note), the SPV will own equity in the LLC once the investment converts into equity. Circumstances for conversion are set in the investment contract itself, usually when the company raises a priced round of a certain size.